10+ Do You Need An Abn To Run A Business In Australia

Find out more here. Once you have the ABN you can apply it through ASIC online application.

How To Apply For An Abn In Australia Fullstack Advisory

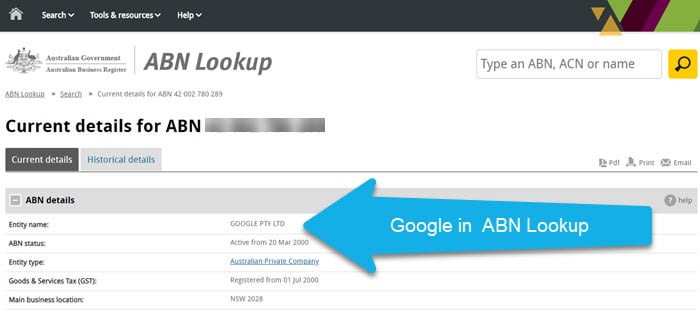

An Australian Business Number ABN is a unique 11-digit number that identifies your business to the public the Australian Taxation Office ATO and other government agencies.

Do you need an abn to run a business in australia. Without an ABN other businesses must withhold 47 from payments they make to you for tax purposes. Deductions you can claim. Starting your own business.

There is no requirement for a business to register for an ABN. To get one you need to be running a business or other enterprise. If you are running a business it is vital that you register for an Australian Business Number ABN.

An Australian Business Number ABN is a unique registration number for businesses. Non-residents need to provide either. ABN for businesses outside Australia.

When you start a business there are tax and super responsibilities you need to be aware of including. An enterprise among other things is an activity or series of activities done in the form of a lease licence or other grant of an interest in property on a regular or continuous basis. Depending on who the customers of the business will be there can be a huge disadvantage if they do not register.

By registering for an ABN you can also register your business for Goods and Services Tax GST. Some business activities may impact your surrounding residential area. To register for GST you must get an ABN.

We provide information about the key things you need to know and do when starting your own business. The Australian Business Register ABRs definition of an enterprise also includes charities superannuation and property renting and leasing. If you have a home-based business you still need to register for a business name ABN and required business licences and permits.

Whether you are a sole trader a partnership or another type of business entity if you are looking to make a profit from the work that you do then an ABN is a. ABN Entitlement Fact and Fiction. Every registration work in Australia is done under ASIC.

If you do not fit this category whilst not being mandatory it is still useful to register for an ABN. If you already have one for another business you can not use it for your online business. Register for Australian Business Number.

Their Australian tax file number TFN or. Once you register with ASIC the data is saved nationally. If you have an ABN filling up the application shouldnt take more than 20.

Furthermore if you want to register a business name an ABN is required. To be entitled to an ABN you must be carrying on an enterprise in Australia or in the course of carrying on an enterprise you make supplies connected with Australia. For your tax and super basics this video is a good starting point.

When the GST and. Carrying on or starting an enterprise in Australia. Register for Australian Business Number.

Registering an Australian Business Number ABN is compulsory in Australia if you have an annual turnover of more than 75000. You will need an Australian Business Number ABN to do this - but more on those later. Non-residents may be entitled to an ABN if theyre.

Depending on your type of business you may need special permits relating to zoning signage noise levels or health issues. ABNs are unique 11-digit numbers that allows you to conduct a business in Australia. Applying for an ABN.

Non-residents may be entitled to an Australian business number ABN if theyre. Chances are this will be your biggest start-up cost besides materials. To check if you are entitled to an ABN go to abrgovau and use the entitlement tool.

Ad Apply for your Official ABN for your business online. If you dont have an ABN for your business other businesses have to withhold 49 of their payments to you. If youre starting or carrying on an enterprise in Australia you need an ABN.

Visit the Australian Business Register ABR website to find out about your entitlement to an ABN. You must apply for your own director ID to verify your identity with the Registrar of the Australian Business Registry Services ABRS. Carrying on or starting an enterprise in Australia.

Not everyone is entitled to an ABN you must be running a business. However before you apply it you should have an ABN or be in the process of having one. You will need to provide relevant identification details in order to acquire one.

Intellectual property is a broad term that refers to things like your brand name logo slogans and designs. Whilst you may be able to operate without an ABN if your turnover is less than 75k as weve outlined above its not always the best option. It is not compulsory for businesses to register for an ABN however getting an ABN is free and makes running your business easier particularly if you have to register for other taxes like GST.

If you apply for an ABN and youre not entitled to one your application may be refused. Carrying on an enterprise means running a business or engaging in commercial activity like selling goods and services. Making supplies connected with Australias indirect tax zone.

Protect Key Elements of Your Brand. Its free to get an Australian Business Number but you may not need to early on if the tax office believes youre running a hobby business it may not require you to register. For creative entrepreneurs intellectual property is often the heart of your business.

It is issued by the Australian Business Register ABR which is a branch of the Australian Taxation Office. Ad Apply for your Official ABN for your business online. Applying for an ABN.

Not everyone needs an ABN. An ABN number can be issued to many types of business entities including sole traders corporations partnerships unincorporated associations and body corporates. This 11 digit number allows you to avoid any taxation problems that may arise if you try to operate a business without one.

You are also responsible for your own income tax superannuation and GST if applicable. You will need to speak to an insurance broker about the kind and level of insurance you need. If youre a sole trader expecting annual turnoverof more than 75k you must apply for an ABN and register for GST.